Finanz Butik Cash

Outperforms CDs and US Treasury bonds

With a fixed-income investment

5% - 8.8%

Fixed annual return

And USD

Finanz Butik Cash - Benefits

Save in Dollars

1

Performance in dollars

Estimated returns from 5% to 8.81% per year, depending on the term and amount selected.

2

Flexible deadlines

Choose a period of 6 months to 2 years.

3

Outperforms CDs and US Treasury bonds

Access an alternative designed to generate income in US dollars through structured instruments backed by residential real estate.

4

From US$15,000

Generate income while building your savings fund.

5

Performance Tailored to You

Choose between receiving quarterly payments in dollars (applicable for terms of one year or less) or capitalizing your investment until maturity with FBcash.

FB CASH

CASH

FB Cash I - Tier 1

USA

Min. investment

$20,000

Term

6 months

Rate

5-6%

Distribution

Quarterly

CASH

FB Cash Cap - Tier 1

USA

Min. investment

$20,000

Term

1 year

Rate

7.21-8.27%

Distribution

At Maturity

FB Cash Cap III - Tier 2

USA

Min. investment

$20,000

Term

2 years

Rate

8.5%

Distribution

At Maturity

CASH

How do I start investing in FB Cash?

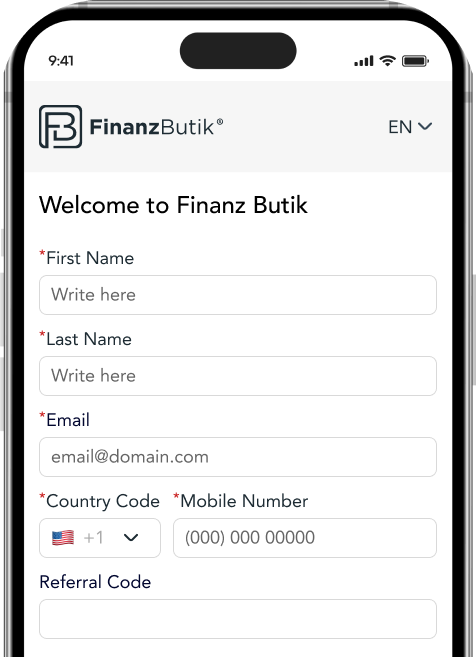

01

Create your Finanz Butik account

Tell us about your investment experience, goals, and preferences so we can personalize your investment experience.

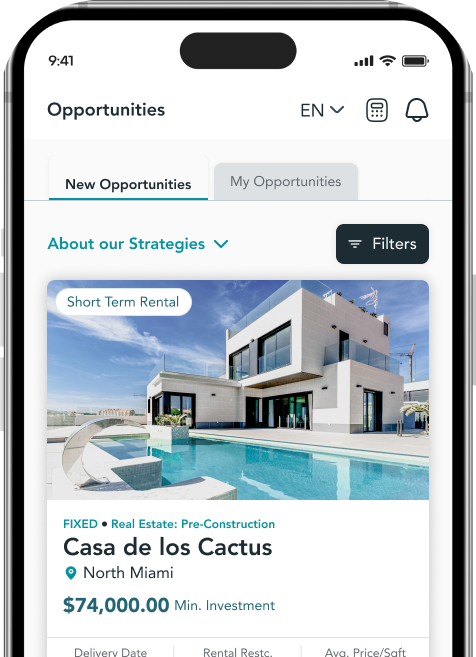

02

Choose your preferred opportunity

Choose the term, yield, and payment frequency that fit your investment goals.

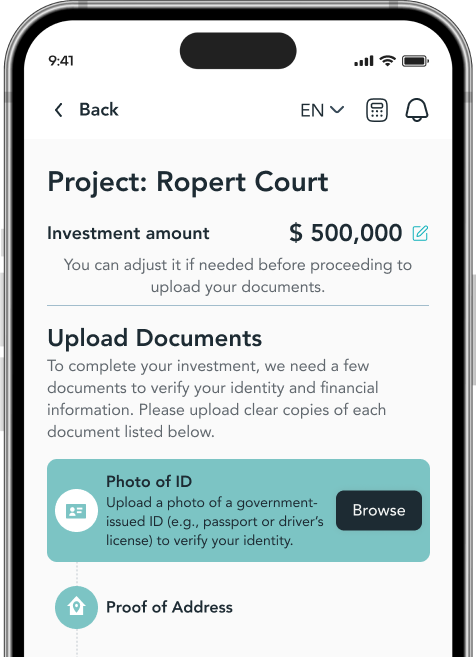

03

Complete the KYC and make your transfer

Add your documentation directly to our platform and follow the instructions to complete your transfer.

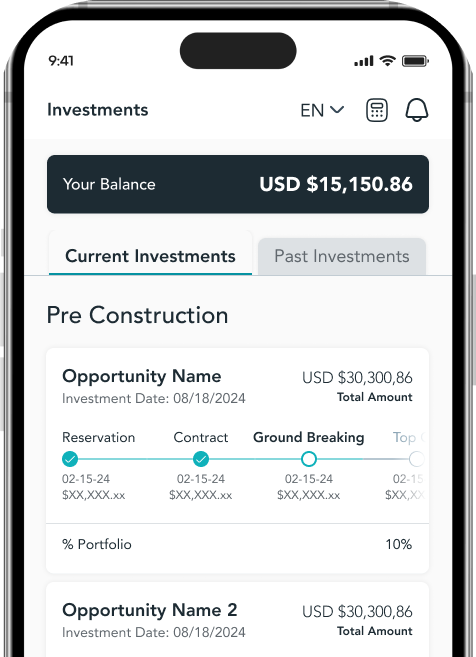

04

Start earning from Day 1

Receive payments and monitor the performance of your investments from your Finanz Butik app.

Frequently Asked Questions

We believe in clear and simple investments. Explore our FAQs and, if you need more information, don't hesitate to contact us anytime.

How do I start investing with Finanz Butik?

To begin your investment journey with Finanz Butik, follow these simple steps:

- Create your account: Sign up on the Finanz Butik platform.

- Explore the opportunities: Browse through our wide range of investment options, including investment funds, developments, and direct property investments.

- Access our market services: Take advantage of our property management services and more.

- Prepare your documentation: Make sure to have your official photo ID, proof of address, bank statement, and tax identification number ready.

We make remote investing simple, secure, and hassle-free—handling everything from project tracking to operations and maintenance in the United States.

Start today and let us take care of the details.

Who can invest?

Our investment opportunities are open to individuals, institutions, and companies in Latin America, as long as they are over 18 years of age. We welcome investors regardless of their prior experience in the real estate market. We offer solutions designed to help everyone build wealth in the U.S. real estate market.

What is the minimum ticket to invest?

The minimum investment amount is as low as $5,000 USD on certain occasions, allowing almost any investor to access flexible, scalable, and high-yield investment options.

What is the minimum investment period?

The minimum investment period for our opportunities varies depending on the option chosen. For lending, the minimum investment period is 2 to 3 years, allowing your capital to grow and generate consistent returns.

Where can I see my returns?

From your Finanz Butik account, go to the "Transactions" section, where you can access your returns and view all transactions related to your investments.

What is the tax impact of investments as a non-US investor?

Most of our investments in Deals and Private Notes (PN) are structured so that no U.S. taxes are withheld from the investor, allowing them to pay taxes in their home country.

Are there structures designed for American investors?

Yes, we also have specific structures for American investors, in which taxes are withheld according to U.S. tax regulations.

Are there risks when investing in promissory notes?

As with any investment, there are risks. Promissory notes are considered relatively low-risk investments, but it's essential to carefully review the terms and understand the potential risks before investing.

Other Investment Products

Your Simplified Real Estate Portfolio

With us, you can develop an asset portfolio that goes beyond a simple real estate investment. We offer diversified opportunities, customized strategies, and access to key sectors to maximize your growth and profitability.

Save in Dollars

Lend

8-11.5%

Terms: 2 to 3 years

Monthly Payment

From US$20,000

Buy

10-20%

Variable Rate

Invest in properties and generate rental income.

Terms: 3-5 years

Variable Payment

From US$350,000

3%-8% Income

(Cash Flow)

Invest with the most prominent US developers.

Develop

20%+

Variable Rate

Terms: 3 years

Variable Payment

From US$100,000

0%-8% Income

(Cash Flow)